In our previous articles we’ve looked at A National Development and Impacts on the Environment. In this, our final article in the series, we look at the impacts that cruise tourism has on the economy and the local communities visited.

Is Cruise Tourism of real benefit to the communities it visits?

According to Cruise Lines International Association (CLIA) Asia produces just 10.4% of the overall Cruise Market. But by the end of 2018 there will have been more ships in Asian waters, than in previous years. The Philippines are keen to gain a greater foothold in the Cruise Tourism market and not just with more ship visits but also a significant increase in the Large Vessel (2,000 to 3,500 passenger) Category [1.]

But is it the case that more ships and more passengers = greater economy? And what about the impacts on destinations ‘traditional’ tourists?

Cruise Tourism: Impacts on Economy and Communities

Some may argue that Cruise Passengers are an additional economy to an area, alongside ‘traditional’ tourists and should be welcomed. But others will say that they mire the experience of ‘traditional’ tourists and their willingness to return to the area in the future.

Cruise ships can release anywhere between 300-3,000 guests on one area, and half those numbers again in crew members. Such numbers put a strain on local resources such as transportation, restaurants and bars, which struggle to accommodate the numbers, and impacts on the experience of other ‘traditional’ tourists staying in the area.

In addition, the trend among Cruise Lines now are all-inclusive deals, aboard state-of-the-art vessels. This leaves passengers far less likely to want to spend money ashore; food, accommodation and even entertainment and activities are available on board, and have already been paid for.

“If you have a cruise liner which is drawn up in the port, the chances are the people will have had a good breakfast on the boat. They might take lunch somewhere in the city, but they probably won’t be very hungry, and they will probably have dinner back on the boat” Dr Harold Goodwin, Managing Director, Responsible Tourism Partnership and Responsible Tourism Programme Adviser to the World Travel Market. [2.]

Many Cruise Destinations are themselves undertaking studies to assess the economic and environmental impacts on the destinations, and surrounding communities visited by Cruise Liners. In July 2016, after one such study, the United Nations threatened to place Venice on UNESCO’s list of endangered heritage sites if Italy failed to completely ban giant cruise ships from the city’s lagoon by 2017 [2.]

Two destination studies below surveyed both resort guests and cruise guests, to determine the level and types of daily spending each brought, in destinations that had witnessed a significant increase in Cruise Tourism.

Example 1: Impacts on Economy and Communities – Vanuatu, South Pacific (an Ocean nation made up of roughly 80 islands).

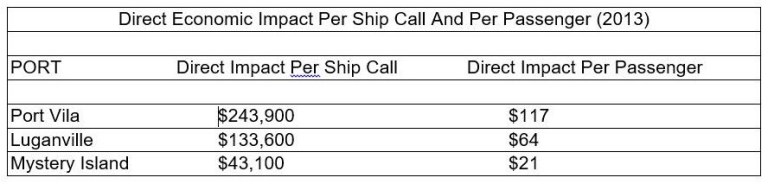

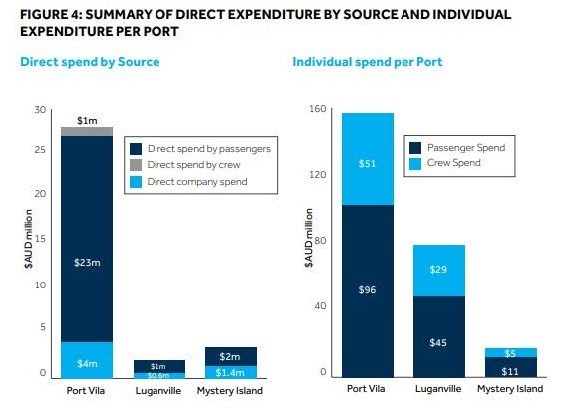

In 2013 the Australian Department of Foreign Affairs and Trade, Carnival Australia and IFC undertook a study on the impact of Cruise Tourism to Vanuatu [3] after the area saw a boom in cruise arrivals. Vanuatu hosts three main Port Calls at Port Villa, Luganville and Mystery Island, and the study showed that in one year passengers and crew spent around $36.4 Million (Australian Dollars).

The main sources of direct economic expenditure, highlighted in the report were:

• expenditure by passengers going ashore on the day of their visits (including local portion of pre-purchased tours)

• expenditure by cruise companies on services such as port agent services, and port/landing fees and dues;

• expenditure by crew members going ashore (concentrated on food/beverage and local transportation).

pg 7 Assessment of the Economic Impact of Cruise Ships to Vanuatu Report – Australian Department of Foreign Affairs and Trade, Carnival Australia and IFC

The Premium ships guest surveys reported a lower average spend per port, rather than the higher average spend that we might expect. This is reflected globally; premium ships tend to be all-inclusive, have longer itineraries and visit a higher number of ports, so guests budget out their daily spending.

Ports where there were more opportunities to spend on tours, restaurants and souvenir shops saw a greater level of guest satisfaction and spending, and a higher positive response to the possibility of returning to the destination, within the next 3 years. But there was also a significant difference in total expenditure at the destination, between those who purchased tours in advance and those who did not; passengers spent less in the destination if they had pre-purchased a tour via the Cruise Line.

The Millennium Challenge Account (MCA) had previously undertaken an assessment of tourist spending in Vanuatu, 5 years earlier. Surveying both cruise guests and resort tourists. In the MCA report the average daily spend was $181 for a resort tourist compared to $235 for a cruise ship tourist. However, the average length of stay was 7.7 days for a resort tourist compared to 1 day for a cruise ship tourist, generating a total (direct) spend of $150 million by resort guests, compared with $20 million for cruise ship tourists.

The MCA study concluded that resort tourists bring more economic impact to the destinations than cruise tourists, and across a wider range of businesses. Resort Tourists had a greater range of options for where they spent their money; with no time constraints, the varieties of tours, restaurants bars and shops were unlimited for them. Cruise Guests had fewer options, either because they were pre-booked with a Cruise Line selected provider or because of time restrictions at the destination.

Example 2: Impacts on Economy and Communities – Charleston, USA.

If we look at a one year study undertaken by the State Ports Authority for Charleston (USA), with 69 Cruise Ship visits. It estimated the average spend by a cruise passenger visiting the town, was between $43 and $66 [4.]

The study went on to estimate direct spending by cruise guests, in the town, at $5.5million; an overall $37Million a year boost to the local economy. The study stated that the benefits of cruise tourism didn’t just come from the passengers, but from the crews too, with an average of 900 crew members looking to spend wages, and stock up on essentials and luxuries.

The Charleston Area Convention and Visitors Bureau disputed the survey, arguing it was based on estimates and that its validity was undermined because it was paid for by the State Ports Authority, which had a vested interest in retaining, and increasing, the volume of cruise ship visits to the town. The Bureau went on to compare the spending power of ‘traditional’ tourists, at around $170 per day against the tiny $43-$66 average daily spend by cruise passengers. A marked difference in spending.

A local Charleston business owner, Holliday, with 3 hotels and 4 restaurants agreed that he saw little increase in his business revenue during cruise visits. He also expressed concern that the feel of the town was changing, in response to the cruise visits, with an increase in mass-produced, ‘tacky’ and cheap souvenir shops at the expense of the shops and feel the town had been famous for. A trend also felt by Barcelona [2]

Jim London, Clemson University, who had carried out a similar study in Key West agreed with the Charleston Visitor Bureaus assessment. He highlighted that 98.6 percent of direct tourism expenditure came from non-cruise guests, advocating that a focus on ‘traditional’ tourists should take precedence over cruise tourism in the area.

“It is important not to lose sight of the golden egg. The crowding-out effect of large numbers of cruise passengers disembarking does encourage both traditional tourists and residents to stay away from high-impact areas.”

Jim London, Clemson University

One conclusion in the Vanuatu study was that a comprehensive view of tourism development in the area should take into account the differences between resort and cruise tourists. That separate tourism strategies should be developed for attracting each, encouraging both resort and cruise visitors to spend time in the outer islands, in order to reduce congestion and backlogs (in tour bookings) at the main destination.

Encouraging Local Economy Growth:

“I think you need to be very convincing about the economic benefit… you’ve got to ask what they are going to spend money on. They’re certainly going to visit some of the sights, but in Venice for example, less than 20% of people actually go to the Doge’s Palace. So that would suggest that over 80% of all the visitors are not paying to get into anything while they’re there. They are just enjoying the free public realm aspects, and the same would be true in Barcelona.”

Certainly what has been highlighted by these studies is that when guests are required to pre-book tours via the ship, which are significantly more expensive than tours booked directly, the guest spends less money in the destination itself.

Yes, the tour operator still receives the cost of the tour, with the remaining mark up pocketed by the cruise line. But this means that only certain local operators, who have a contract with the cruise line, are benefiting from the cruise guests.

GoPalawan.travel, an Online Travel Agency in the Philippines, has noted a worrying trend in the cruise lines visiting Palawan Ports. Some Cruise Lines have tied local Tour Operators, they’ve chosen to work with, into contracts which do not allow them to accept direct private bookings from their cruise guests. Instead the Tour Operator has to turn away such bookings or redirect the guest back to the more expensive Cruise Lines Tour Bookings.

“It’s not a problem in Puerto Princesa because the Cruise Lines must be working with a different Tour Operator to the one we use. So we can accept advance bookings from Cruise Passengers, tailored to their arrival and departures times, saving them a huge mark-up and guaranteeing that the whole cost comes in to the Philippine economy. But in Coron we can’t organise private tours for cruise guests, because our Tour Operator is the same one contracted by the Cruise Lines that visit there.”

“We also have to spend considerable time assuring the guests that they will be returned to the ship on time for departure. This stems from a lot of Cruise Lines advising their passengers that the ship will not wait for them, if they choose to book their own excursions and not the Cruise Lines excursion, and are late back. This feels like another tactic to try to encourage guests to book their, more expensive tours and limits the opportunity for other businesses in the area to benefit from cruise tourism. We’ve not yet had a party of guests late back for departure.”

With such contracts in place any economic benefits are being restricted to just a few businesses. Rather than giving guests the choice to select who they wish to book with, and giving local businesses in the destination an opportunity to benefit from such arrivals. The two studies above already indicate that Premium Cruise Guests spend less per destination, as do those guests with tour bookings via the Cruise Line. For true economic benefit local destinations must discourage such restrictive contracts and look at ways to work with the Cruise Lines to enable more businesses to benefit.

Certainly, this is one of the complaints from residents and businesses on Boracay which, up until the islands closure, faced the highest number of port visits in the Philippines. With many complaining that the visits brought little economic value to the majority of local businesses, and undue pressure on resources such as transportation, impacting on the resort guests enjoyment of the island.

Cruise Tourism: Does it fit with in with the drive to turn Boracay into a Sustainable Tourism Destination?

It seems bizarre that after closing Boracay Island for 6 months, for some serious and much needed and requested rehabilitation, as well as publicized aims to turn the island in to one of Sustainable Tourism, the Cruise Ships are being booked to begin their revisits in 2019. And when the island won’t be fully rehabilitated until Dec 2019.

In August 2018, Niven Maquirang, Caticlan Jetty Port Administrator was quoted, saying that at least 28 Cruise Ships would visit Boracay in 2019 [5.] In previous years Boracay Island has only had to suffer up to 12 Cruise visits a year. This announcement was at the same time as the Department of Tourism was asking the country’s airlines to reduce the number of flights to Caticlan and Kalibo airports, to assist them in limiting daily tourism numbers on the island [6.]

“They said they would reduce the number of flights to Caticlan and Kalibo. The only way you reduce the number of people going to Boracay is to lessen the flights going there, since 98 percent of the visitors go by air.”

Tourism Secretary Bernadette Fatima Romulo Puyat

If anything there are plans to continue to expand on Cruise Tourism to Boracay.

In March 2018 the Aklan Governor Florencio Miraflores spoke about the expansion plans of Royal Caribbean Cruises Ltd for Caticlan Port, as a Home Port [7]

A 2.6 Hectare reclamation area of Caticlan Port was identified in February 2018. The Port will allow RCC’s largest vessels catering for upwards of 5,000 Passengers, to Home Port in Caticlan (refer to our previous article for the potential environmental impacts this will bring to the Caticlan community).

“A little bit longer term we think, as the Chinese expands their travelling for leisure and volume, the places like Boracay will become available to them and even possibly in the medium and long term, ships may be able to begin and end cruises from Manila or from Boracay because of Chinese and others flying to the destination in the Philippines possibly doing a hotel stay before or after the cruises, taking a cruise in the region.” Adam Goldstein, Royal Caribbean Cruise’s President and Chief Operating Officer

Certainly such a port will bring more jobs to the area but along with it will come even greater pressure on Boracay Island unless steps are taken to develop alternative tourism opportunities around Aklan and Boracay’s neighboring islands, to reduce footfall on the island.

Ultimately it seems that the people of the Philippines can not escape the drive to expand Cruise Tourism in the country. But to ensure that the destinations themselves feel the benefits, economically or otherwise, more needs to be done to expand opportunities.

The Charleston Hotel and Business owner mentioned earlier, Holliday was frustrated that he was required to spend hours securing permits, getting approval for his businesses and paying out thousands of dollars in taxes. When a ‘traveling resort, three times the size of the city’s biggest hotel, is allowed to escape those same fees and scrutiny’. Transparency is required regarding the deals secured between Cruise Liners and local Ports.

Destinations must receive help and guidance to draw up separate tourism strategies. Strategies that have been developed to cater to the needs of resort tourists, and of cruise tourists. These may include helping destinations to develop new tours and activities in locations away from the primary destination, in order to reduce congestion at the main destination. It may include government or NGO funding for the development of locally-based cottage industries and co-operatives focused on producing good quality souvenirs; which reflect the culture or utilize destination by-products such as coconut shells. This, rather than shipping in cheaply made items.

The Cruise Industry is a competitive one. As such, they don’t hold all the cards. And with prime destinations like Boracay and Palawan, it’s in the Cruise Line’s interests to secure Port Calls there to better attract cruise guests. Steps must be taken to set minimum environmental standards that Cruises visiting the Philippines must abide by, whether at sea or when docked. And visiting Ships should be required to pay a relevant level of fees and taxes, based on their passenger capacity.

Finally, destinations must push for regular studies to be undertaken comparing cruise economy, and impact, against that of traditional tourism, with a priority given to maintaining the satisfaction of traditional tourists who typically bolster local economies far in excess of cruise tourists.

Article Sources:

- 2018 Cruise Industry Outlook: State of the Industry – CLIA

- A cruise too far: how overtourism impacts the world’s top destinations – Ship Technology

- Assessment of the Economic Impact of Cruise Ships to Vanuatu Report – Australian Department of Foreign Affairs and Trade, Carnival Australia and IFC

- Are cruises a boon for local economy? The Post and Courier

- 28 cruise ship arrivals expected in Boracay in 2019 – GMA News

- Carriers mull over flight cuts to lessen tourist visit to Boracay – Business Mirror

- Aklan guv sees great opportunities with Caribbean homeport in Caticlan – Aklan Forum Journal

GIPHY App Key not set. Please check settings

One Comment